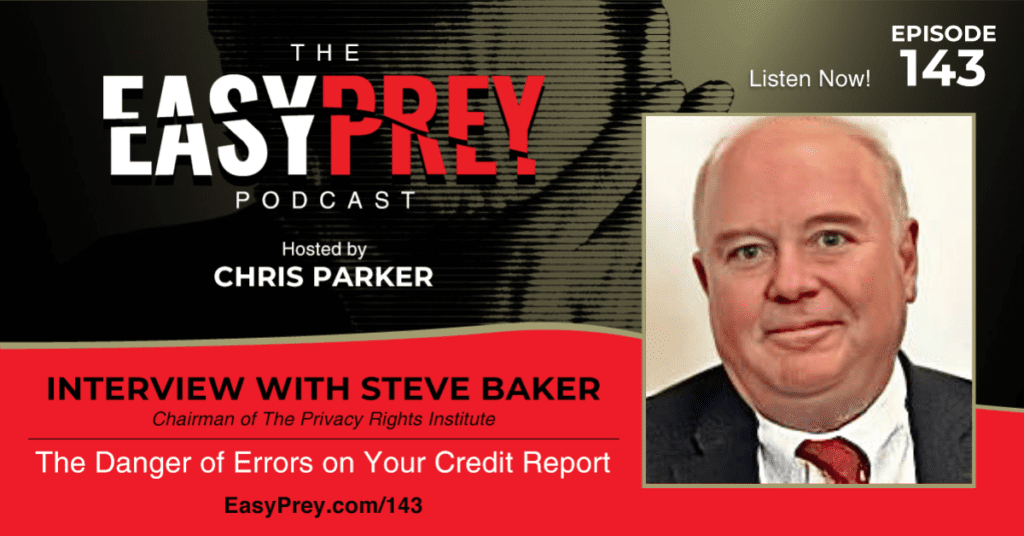

Every time you pay a bill, data is sent to a credit reporting agency. Errors can be made. It’s important to know where to look to see if your credit information is correct, stolen, or purchased. Today’s guest is Steve Baker. Steve is chairman of the Privacy Rights Institute. He is a lawyer and previously served as a leader at the FTC for over 27 years addressing consumer fraud in areas like telemarketing and spamming. Steve now writes The Baker Fraud Report, a free weekly newsletter covering consumer fraud from around the world.

“We’re all being bombarded everyday with spam, text messages, scams, bogus websites. We all need to watch out and it impacts everybody.” - Steve Baker Share on XShow Notes:

- [1:08] – Steve shares what he currently does with The Baker Fraud Report and his career background.

- [2:46] – In the field of consumer fraud, there is always something to learn.

- [3:27] – The Privacy Rights Institute is meant to educate people on their rights regarding credit reporting.

- [5:02] – With tons of pieces of data, errors can occur.

- [6:05] – Steve shares some of the people who can pull your credit report.

- [7:34] – One error happens when people with the same name get mixed up.

- [9:04] – Steve explains how the system is supposed to work.

- [11:07] – Unfortunately the credit reporting agencies have poor customer service.

- [12:54] – Credit reports can also be pulled by employees and associates at places like car dealerships. There’s no stopping them from searching anyone.

- [13:40] – Data breaches are also a concern and can lead to identity theft.

- [15:27] – The Los Angeles school district recently experienced a data breach through ransomware.

- [17:25] – There are some alternatives that are starting to come out for security.

- [18:56] – With the increase in people changing jobs and the economy in its current state, credit reports are being pulled more frequently at the moment.

- [21:09] – You can get a copy of your credit report once a year. Do this at AnnualCreditReport.com.

- [22:26] – If you see an error, reporting it to one agency is good. Keep an eye on your credit card bills.

- [24:24] – Scammers have also been known to alter recordings of your voice on the phone.

- [26:04] – If you see an unusual charge, don’t try to locate or contact the person who made the charge.

- [27:48] – Currently, the best way for scammers to get your money is through cryptocurrency.

- [29:07] – Immigrants are particularly hit hard by scammers and credit report confusion.

- [31:01] – Keep an eye on your credit reports and periodically check for errors.

- [32:06] – Steve explains how credit repair works and what to look for.

Thanks for joining us on Easy Prey. Be sure to subscribe to our podcast on iTunes and leave a nice review.

Links and Resources:

- Podcast Web Page

- Facebook Page

- whatismyipaddress.com

- Easy Prey on Instagram

- Easy Prey on Twitter

- Easy Prey on LinkedIn

- Easy Prey on YouTube

- Easy Prey on Pinterest

- AnnualCreditReport.com

- Baker Fraud Report

Transcript:

Steve, thank you so much for coming on the Easy Prey Podcast today.

It's a pleasure to be with you today.

Can you give myself and the audience a little background about who you are and what you do?

Sure. I'm retired from the Federal Trade Commission where I worked for 34 years running the Midwest region in Chicago. Since retiring, I've also done some in-depth studies for the Better Business Bureau on common frauds that people encounter every day. I also do a weekly fraud newsletter that goes out around the world at bakerfraudreport.com. If anybody's interested in the newsletter, just go to the website. There's a signup form there at bakerfraudreport.com.

I've been doing fraud for over 30 years. There are a whole lot of things that the Federal Trade Commission does obviously, but it's something I've always really been interested in—how it works, who is behind it, and the international aspects of it.

I even spent a few months as a federal prosecutor. It's a subject that is eminently practical because we're all being bombarded every day with spams, text message scams, and bogus websites, and we all need to watch out. It affects everybody, so it's really an important issue. I'm glad you're doing a podcast on these things.

Yes, it's been very illuminating. You talked about being at the FTC for 34 years and dealing with fraud. Was that a result of something that happened in your life or someone you know, or was that just the trajectory that your career ended up taking?

It was the trajectory of my career. We had just started at the Federal Trade Commission. We just got the authority to go into federal court to freeze assets and have receivers appointed. I recited one of the first big cases there. It was obviously an area that needed a lot of attention, and I've always remained interested since then. There's always something new. There's always more to learn. It's a huge area out there, worldwide.

I'm glad that you've decided to use part of your retirement time rather than golfing to help people.

Like I say, I wish I knew how to play golf, but I'm not a golfer. But this keeps me busy, that's for sure.

Let's talk about the credit reporting system and a little bit about that along with the Privacy Rights Institute that you're currently working with. Can you tell us what that is and what it does?

Sure. The Privacy Rights Institute is meant to educate people on their rights under credit reporting and in making sure they really know what's going on. We are really taking a look at the credit reporting process. This is so important for all of us.

People talk sometimes about big data. They worry that data brokers are going to pull this information together, but that information is already there and it has been. I don't think people realize just how extensive this is because every time you pay a bill, apply for a loan, or use your credit card, all that information gets reported to one of the big three credit reporting agencies, and they compile it in their credit report.

There are all sorts of people who can pull credit reports about us and learn about what we're doing in ways that are really going to affect our lives. For example, if I go to try to rent an apartment, before they issue a lease, they're probably going to pull a credit report to see if I paid my bills on time, filed for bankruptcy before, got judgments against me, or anything that's going to interfere with my ability to lease the apartment. That information is available with a few keystrokes on basically anybody that rents apartments in the United States.

I may not even know they're doing it. I may not even know that there's information in there. There's a lot that can go wrong with credit reports as you'd imagine. With billions of pieces of data from hundreds of thousands of companies reporting in different forms to credit reporting agencies, errors can and do work out. There are also issues with unauthorized access, which leads to identity theft, which the last time I looked was the number one source of complaints to the Federal Trade Commission. That happens a lot, unfortunately.

What kind of data and information is on the credit reports that entities can get ahold of?

The people that provide the data are called furnishers, Basically, anybody you pay a bill to, whether it's Joe's Furniture down the street where you bought a couch, repaying your credit card bills, paying your mortgage, or any other credit. That information is all going to go back in in addition to public record stuff, such as bankruptcies or judgments against you. That's all combined in the credit report about you in particular.

That is the information that the credit reporting agencies tried to provide their business. They sell that. It's a good system in many ways. In the United States, I can go to a car dealership with just my ID if I had to buy a car, drive it away, and probably even finance it, and I don't have to bring in any financial documents at all.

The reason for that is they've got my credit report. They know what's in it and they can make a pretty good judge on whether I'm just a thief, somebody who’s stealing the car, or not. On the other hand, that information, like I say, can be cumbersome to compile. Errors can creep in, some of the credit reporting agencies have had major data breaches, and like I said, I may not know what's going on.

Where does it go wrong with respect to bad data and things about us that might not actually be correct?

Several things can happen. First of all, they can mix up the data with other people. There can be two Chris Parkers in the same apartment complex, same name. They get the files mixed up and they get confused. They try to keep it straight with Social Security numbers, but not everybody requires those, and sometimes, those don't get reported.

In addition, the people providing them with the data may be making errors. For example, Apple had a big issue a year or two ago where they were referring to all of their former employees as associates, which were not people's job data. People were applying for jobs, the companies look for verification of their income, salary, and their job titles, and are like, “Look, this person says they did X, but this says that they were just an associate, so they must not have been a very serious employee.” There was a class action over that.

The other data from the furnishers may end up being inaccurate. The problem with that is that you don't even know what they're reporting about you. Sometimes, they're supposed to get permission first before they get verification of employment, but they don't always do that. Sometimes, it's just fine print, so people don't even know what it is they're signing over.

The way this system is supposed to work is that if they pull a credit report or other information about you, like verifying your income, decide not to hire you, or charge you more for credit than they normally would because of something in your credit report, they're supposed to send you a notification and an opportunity to get a free copy of your credit report so you can go fix it. But by that time, you've already lost out the job. It's a real problem. The credit reporting agencies are not necessarily really good about fixing real errors.

From the consumer's perception, “Why are these entities doing this to me? I'm a customer. Why aren't they treating me better?” The issue is that we as consumers really aren't the customer, so maybe they don't have as much motivation. If I'm to say, “Hey, this is wrong.” Well, am I really their customer?

I think that is a problem. At one time, they were leaning towards changing that incentive structure a little bit because they were charging people for credit reports. They're making money from consumers, but no customer service is bad. It is across the board. Automated system is the cost of hiring real people, but people don't want to do it.

We get automated systems, errors happen, and the feedback that comes back sometimes is really poor. The Consumer Financial Protection Bureau says that over half of all the complaints that go to them—and they regulate the banks and credit card companies—are about the three credit reporting agencies.

It is really, really huge. They've got a long history of bad customer service. Partly, they blame that on credit repair companies claiming that they're tired of dealing with all sorts of frivolous disputes, which in some ways they are, but people just don't want to spend the money.

I found that customer service is really a problem. I found when I was at the FTC that we were investigating companies for different practices like false made-in-the-USA claims. When we ask them for complaints that they'd received from consumers about this issue, they're like, “Oh, we don't have any.” Then, we get into litigation, and it turns out that they have thousands of complaints. They just don't pay any attention to them. It always made me crazy.

These same businesses will go out and hire people to do consumer surveys and other studies on consumer satisfaction. They've got free feedback from their own customer complaint system that's just Agnes stuck in a corner of the basement somewhere. Nobody pays attention to her, and she's got all this free data inside. It always made me crazy. The companies don't pay more attention to their complaint systems than they do.

I think with credit reporting agencies, if I'm a business and I'm paying them X dollars for every request that I do, they're more inclined to respond if I have an issue with their platform versus a consumer who is not paying them any money.

Right. That could well be. It's a difficult issue, but real problems really do occur. The other thing, of course, that can happen is if you've got people in every car dealership in the country with a terminal where they can pull up credit reports, what's to keep them from checking out somebody they know or pulling a credit report inappropriately? That can certainly happen.

It's a crime, but I'm sure that people don't realize that, and I'm sure it happens from time to time. It's a real problem.

The other thing, of course, is data breaches. Equifax had a data breach several years ago where the hackers got information on 150 million customers from their systems.

I was one of them.

Experian has had a couple of incidents like that too, because you can imagine, hackers are desperate for this information. If you've got somebody's personal information, then you can do identity theft. You can apply for credit cards in somebody's name or you can get a mortgage on somebody's house. That can screw people up.

Even if it isn't going to end up costing you money, it's still hundreds of hours sometimes to straighten these situations out. There's a worldwide network of crooks out there that are working every day just to get that information. It's worth a lot of money.

It's not just some infamous hacker in a hoodie in a basement just trying to have a little fun. These are legitimate criminal enterprise organizations with hundreds of thousands of people.

That's right. I think people have that view. They think it’s some sort of a teenager in a cybercafé or whatever, but these are real international organized crime gangs, and sometimes they're foreign governments. I've seen speculation that the Equifax breach was actually done by China. I can't say it wasn't. It certainly could happen. These are big organized crime gangs. They can sell information on the dark web for massive amounts of money.

The Los Angeles school system just had hackers get into their system. It was ransomware, I've heard, where they locked up and encrypted all their data. LA refused to pay, and now they started taking all these records on all students and staff and dumping them on the Internet.

This dark web stuff is scary. I recently saw an article suggesting that I could get your credit card number for $0.15. There's a whole lot out there. The data security part is really important. In addition, of course, the people that provide the data to the credit reporting agencies also can and often are hacked.

This dark web stuff is scary. I recently saw an article suggesting that I could get your credit card number for $0.15. -Steve Baker Share on XThere is a lot of information out there floating around about us. We just really need to know and understand how this credit reporting system works so we can try to protect ourselves and try to get better information from them about what they're doing and a chance to look at the data and make sure it's right before people make decisions about what to do with us.

You were talking earlier about employment lookups and employment verification. Is that part of the existing credit system, or is that a separate business or different entity?

It is the same entities that are doing that. They sell it. I guess if you just want to verify your employment and salary, that's a little bit cheaper than buying a full credit report. There's a question really that some researchers at Stanford have been looking at because Equifax buys that data, I think, from over half the employers in the country. They've got information on more than half of us.

They can sell just that information. They claim they segregate that from their full credit reports, but they've been a little bit iffy in terms of response. Nobody can really tell if it’s really true that they're keeping that separate or not, but you should know that that's going to happen.

There are some alternatives that are starting to emerge out there. For example, one has a secure lockbox that your employer gives to you. They load your employment information and salary into that—you can't change it yourself—and then you can share the key to that box with a potential employer or somebody else so they can take a look at it.

Of course, you know it's there. You had a chance to take a look at it. You decide who you want to share it with. I think people will be happier with that sort of arrangement because they know what's going on with their data and they know what data is actually being shared.

I suppose we'd love to have that same thing with our credit data as well, not just freezing and unfreezing it to allow someone to do a check in order for us to get an auto loan. But if they're just selling it to other businesses who are looking for credit-worthy people in a particular zip code, we'd love to have control over that as well.

Yes, you would. That's what we're advocating. Today, people have a little bit more control and awareness of how their data is being used because it really can affect us in real life. Especially now with people needing more credit, the economy is starting up, and a lot of people are changing jobs, moving around, and at least exploring new jobs with inflation and after the pandemic. It's a real issue.

Are there entities working on new laws to rein in the credit reporting agencies and give us a little bit more control over what they can and can't do with our data?

We would like to see that. There are also some new business models that are starting to develop that sound a little bit more consumer-friendly. We're just trying to create awareness of what else is going on out there.

Laws without enforcement aren't very effective. For example, I've mentioned credit repair before. California has some of the most stringent credit repair laws in the country, but the state doesn't really enforce them, and California also has the most credit repair companies in the country, which is going on.

The lawsuits under the Fair Credit Reporting Act, which governs this system of credit reports, have tripled over the last 10 years. Errors come in. People are just looking at data and not understanding what they've got. I think systems get their wires tangled. It's a bit of an oligopoly really. We’ve really only got TransUnion, Equifax, and Experian, which are the three companies that sell credit reports and maintain most of this credit report information on us.

What should consumers be doing in order to find out if there are errors on their credit report? If they do, what can they do about it?

There has been a law for a while that you can get a copy of your credit report once a year. Since those are three companies, you could get one every four months and know what's in your credit report. The place to go is annualcreditreport.com. That is run through the Federal Trade Commission. You can get all three credit reports there.

Don't go to alternatives. The FTC actually sued one of the credit reporting agencies some years ago because they were offering a free credit report that ended up being a free subscription that you had to cancel, and then they're also trying to push other products and services that people didn't really necessarily need.

Go to annualcreditreport.com, get a copy of your credit report, and take a look at it. I said that you could get one per year, but because of the result of the pandemic, until December of 2023, you can get any of them free anytime you want. I would definitely do that, try to make sure it's accurate, and then if you have problems, go to one of the credit reporting agencies.

If you report inaccuracies to one, they're supposed to share that with the other two, so you've got a standard form and you don't have to do as much work to fix errors as you used to. Be aware that sometimes, these companies are hard to get a hold of on the phone.

Report to the Consumer Financial Protection Bureau, cfpb.gov, if you can't get any help from the credit reporting agency. You'd be really surprised at how many mistakes there are. Sometimes, people look at their credit reports. If you've got a credit card in Ghana, you've never been there, and you never talked to anybody before, you know something's going on and somebody's using your credit.

The related thing is look at your credit card bills and phone bills. A lot of people don't, and they're astonished. There was a while where the phone companies were allowing third parties to bill us for stuff on the phone bill. You didn't even know it was there.

We had one of our attorneys in the Chicago FTC office who had been paying $20 a month for a year for something she didn't even know she had. It's really important to pay attention to these sorts of things.

Yeah. I remember there was a period of time when in slamming—adding stuff to your phone bill—the common advice was anytime you're talking to someone on the phone that you don't know, don't say yes because they might record it and use that as proof that you authorized this additional charge on your phone bill.

Yeah, that does happen. We actually went in and raided one boiler room in Florida. They've got little tape recordings of people trying to get them to verify the credit card charge so that if the person came back and said, “Hey, this was fraudulent,” and challenged the credit card charge, they can’t get their money back. But they were actually doctoring those tapes. They had a little chart by their answering machine explaining how to do it for the demo employee, so we knew that that was really what was going on.

That brings us to another point, which is really good. I was surprised on one of the studies I did for the BBB where we found out that only about half the people in the country realize they can get their money back on credit card charges they didn't authorize or if it was all a fraud.

A tremendous amount of people don't realize that. Instead, they call the scam company trying to get their money back. They’re not going to give you your money back. Just charge it back on your credit card. A lot of people just don't know that they can do that. They really do need to know that because it's a really useful piece of day-to-day advice.

Yeah. I generally have always operated on that if I see a suspicious charge, obviously, I'll check with my wife and see if she bought something that I didn't realize, which is about 99% of the time. One of us has done something that the other one wasn't aware of in the moment, or the number didn't come out to be exactly what we thought it was.

I've definitely had charges that I didn't recognize on my card, but I don't think I've ever actually even tried to figure out who the charge was from. Actually, I did once or twice try to figure it out, but I definitely didn't try to call them to get the refund. I'm like, “I'm going to go to someone who's going to act in my interest, just reverse the charge, and let them figure it out.”

Yeah. We did absolutely one operation at the Federal Trade Commission. It was $0.10–$0.15 charges, hundreds of thousands of them. We finally traced it back to the island of Cyprus, which is apparently the gateway corridor for Russian organized crime.

I lost the trail after that, but these people were collectively getting massive amounts of money in just very little dollars. You look at your credit card, “Oh, $0.15. It’s not even worth the time to make a phone call. They're raking in millions from that sort of stuff.

Fifteen cents across hundreds of millions of people will get you a lot of money.

Yes, it will.

Are there any benefits of using credit cards versus debit cards?

They're working a little bit differently. I always use a credit card. I know I can chargeback. There's a little bit of a different system with debit cards, but you can charge back against debit cards too. People should be aware of that.

It's a whole other topic we could do for another day, but one of the things that I always find interesting is how do scammers get your money? No point in running a scam if you can't get paid, so they want the money.

Recently, the number one way of getting your money is through cryptocurrency. There are thousands of these Bitcoin ATMs around. My local gas station has got one. You just plunk in $50 bills, they send you a QR code on your phone, you hold it up to the screen, and your money is gone. You have no idea where in the world it just went to. The number one way is by using crypto.

The second most popular is gift cards. People don't know that if you give them the number off the back of your gift card, that's as good as just giving them the card. They don't need the card. It can be gone in nothing flat.

And no government agency accepts gift cards as a form of payment.

That's exactly right. There are a lot of people out there calling people claiming they are the US government, often Social Security or the IRS, and sometimes, Immigration and Customs threatening people with deportation, and particularly hitting recent immigrants really pretty hard. That's a problem too.

The other thing with credit reports is I don't know how they deal with issues. If I'm here illegally from Nicaragua and I want a job, I’ve got to have a Social Security number. I can't just pull one out of thin air. I'm probably using somebody else's. That could be yours, so it'd be worth to try to find out if that's going on. I wonder just how much of it really does happen. That could be a real problem.

On the one hand, the immigrant got somebody else's Social Security number. Maybe they're paying into Social Security even though they're never going to be able to collect it. That's a potentially massive issue out there that doesn't get talked about.

Of course, the other thing that goes on is that there are government benefits like the Covid PPP loans or unemployment benefits. Scammers from around the world have stolen tens of billions of dollars from those things applying online. Finding people and getting the money back is not an easy thing to do.

Those things have potential tax implications. If someone took out a PPP loan and even repaid it, or didn’t, or got Covid relief funds under my name, some of those, you still owe the taxes on them.

That's right.

I think we'll find out here in the next couple of years how many of those happen as people start getting audits and get notified by the government. “Hey, you didn't pay the taxes on your PPP loan, or you didn't pay the taxes on the Covid relief funds.” And you're like, “I didn't get anything.” We'll start seeing that come to fruition here in the next few years.

Again, I think keeping an eye on your credit stuff, particularly your credit reports, knowing what's in there, and making sure there aren't any errors is really something we all need to do. It's not necessarily all that difficult to do. You can get it for free right now for the next year or so, but do take a look. Do complain. Speak out. As always, I always encourage everybody to speak out if you've been ripped off. Don't blame yourself. Don't feel guilty. Don't get mad. Speak out about it. Let the enforcement agencies know too.

As always, I always encourage everybody to speak out if you've been ripped off. Don't blame yourself. Don't feel guilty. -Steve Baker Share on XI like that. Any other resources we should be directing people to before we finish off here today?

The only thing that might be worth mentioning is credit repair. First of all, a couple of things people need to know: the creditors really mostly care about what happened to you in the last year or two, not historically really bad problems. They can report bad credit stuff for seven years on credit reports and bankruptcies for 10, but like I say, they're only really interested in the last couple of years.

You can become credit-worthy again. Most people can fairly, fairly rapidly. But there are credit repair companies. We've all heard them on the radio. They advertise, “Bad credit, but we can fix it.” We sued hundreds of those operations when I was at the Federal Trade Commission. Actually, I just saw a guy plead guilty today. I just saw the press release.

Their company had claimed that they had paralegals. They could get bad information off your credit report. They claim to have a team of lawyers and paralegals, and they basically didn't. They can't do it. What credit repair companies really do is just challenge every bit of information on your credit report or claim, which you probably didn't tell them that you're an ID theft victim. The credit reporting agencies have to take that information off temporarily while they re-verify it, but of course, since there's no documentation and it really isn't, then they can't fix it.

There was one credit repair company one time that said they could remove bankruptcies, but what they were doing was going into the clerk of court’s office and the bankruptcy court and stealing court files, which I couldn't believe. But mostly, what these guys do is just write […] letters challenging all the information on the credit report. They can't fix your credit.

They're incredibly, incredibly common, so I really urge people to be aware of those. They're all over the Internet. We all hear them on the radio and TV. There's a federal law—the Credit Repair Organizations Act—which prohibits them from taking any money from you. You don't have to pay them unless they can achieve results. They all violate that because none of them can do it. They're all going to take money in advance.

Again, if anybody's fallen victim to a credit repair scam, we really urge you to step up and report that. Not only civil cases like the Federal Trade Commission does, but now there have apparently been some criminal cases, and that would do a whole lot of good for everybody.

If anybody's fallen victim to a credit repair scam, we really urge you to step up and report that. -Steve Baker Share on XBy definition, the victims of these credit repair stuff are people with bad credit often because of not their own fault, divorces, death in the family, or something like that. They get really behind on their bills, they can't pay them, and then you've got these credit repair guys who come in and take what little money they've got left. It's always been one of my bugaboos.

Yeah. When people have fallen victim to one thing, whether it was a legitimate credit issue or not, people are going to try to take advantage of that vulnerable state and make life worse for them. Awful way to go.

Steve, if people want to find you online, where can they find you online?

I've got a website, bakerfraudreport.com. If they want to sign up for the newsletter, they can send me an email at [email protected], and I'm happy to sign them up. The price is right. It's free. You'll learn about what's going on out there and be able to talk to your friends and neighbors about what kind of frauds they ought to be looking out for and what they need to warn their family members about.

Yep. Steve, thank you so much for coming on the Easy Prey Podcast today.

It's been a pleasure.

Leave a Reply